Enclosures were not allowed in aerogrammes.

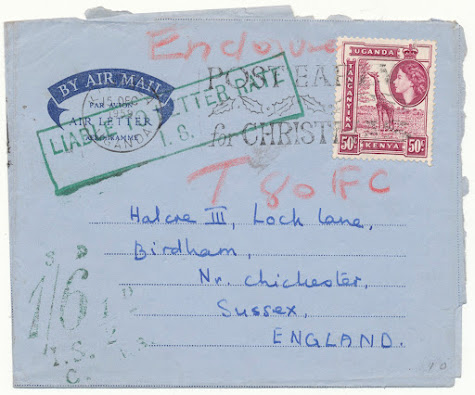

Aerogramme form sent from Kampala (15 DEC 1959) to the UK. The enclosure (stamps as per the message on the writing panel) was detected only upon arrival at the UK .“Enclosure” endorsed with red crayon and a boxed green instructional handstamp “LIABLE TO LETTER RATE I.S.” applied.

Taxed as a short-paid air mail letter upon arrival. The air mail letter rate from KUT to the UK was 130 cent, so the item was short-paid , which was endorsed as T 80 IFC.

The item was taxed 1s 6½d postage due, documented by two green tax handstamps (1s 6d, ½d).

At the time of posting, the UK used its own scheme of calculating the postage due on incoming mail. Double the deficiency in the country of origin's currency had to be multiplied with the ratio of the letter rate equivalent in form P114E (3½d) and the UPU letter rate (30c) of the country of origin.

Postage due = 3.5 x 160/30 = 18.67d rounded to the nearest ½d = 1s 6½d.

No postage due stamps.

This item has been discussed in the Journal of the Postage Due Study Group, vol. 98 and 99, 2021.

Keine Kommentare:

Kommentar veröffentlichen